Archive

Archive for the ‘Finance’ Category

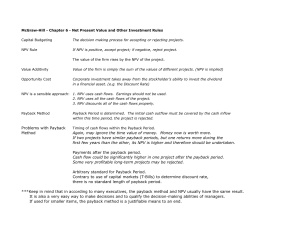

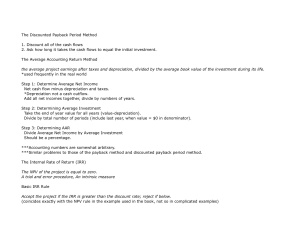

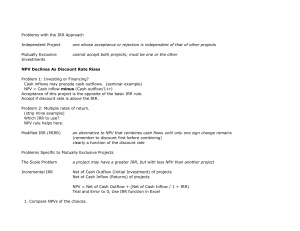

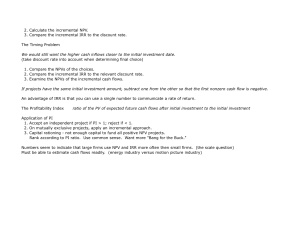

Capital Budgeting Notes

November 5, 2008

Leave a comment

I found a way to save my Excel files as PDFs and then convert those to JPEGs. That should solve all of the formatting issues I’m having. I’ll re-post the other finance notes that I put on BB as html asap.

Cat Financial Ratios

October 25, 2008

Leave a comment

| Caterpillar Inc. Financial Ratios | ||||

| Short-Term Solvency/Liquidity Ratios | ||||

| Current Ratio | Current Assets | 1.15 | ||

| Current Liabilities | ||||

| Quick Ratio | Current Assets – Inventory | 0.82 | ||

| Current Liabilities | ||||

| Cash Ratio | Cash | 0.05 | ||

| Current Liabilities | ||||

| Long-Term Solvency/Financial Leverage Ratios | ||||

| Total Debt Ratio | Total Assets – Total Equity | 0.84 | ||

| Total Assets | ||||

| Debt-Equity Ratio | Total Debt | 2.01 | ||

| Total Equity | ||||

| Equity Multiplier | Total Assets | 6.32 | ||

| Total Equity | ||||

| Times Interest Earned Ratio | EBIT | -17.09 | ||

| Interest | ||||

| Cash Coverage Ratio | EBIT + Depreciation | 14.90 | ||

| Interest | ||||

| Asset Utilization/Turnover Ratios | ||||

| Inventory Turnover | Cost of Goods Sold | 4.53 | ||

| Inventory | ||||

| Days’ Sales in Inventory | 365 Days | 80.59 | ||

| Inventory Turnover | ||||

| Receivables Turnover | Sales | 2.66 | ||

| Accounts Receivable | ||||

| Days’ Sales in Receivables | 365 Days | 137.02 | ||

| Receivables Turnover | ||||

| Total Asset Turnover | Sales | 0.75 | ||

| Total Assets | ||||

| Capital Intensity | Total Sales | 0.75 | ||

| Assets | ||||

| Profitability Ratios | ||||

| Profit Margin | Net Income | 0.12 | ||

| Sales | ||||

| Return on Assets (ROA) | Net Income | 0.09 | ||

| Total Assets | ||||

| Return on Equity (ROE) | Net Income | 0.55 | ||

| Total Equity | ||||

| Market Value Ratios | ||||

| Price-Earnings Ratio (P/E) | Price per Share | 6.96 | ||

| Earnings per Share | ||||

| Market-to-Book Ratio | Market Value per Share | 2.84 | ||

| Book Value per Share | ||||

| DuPont Identity | ||||

| ROE | Net Income x | Sales x | Assets | 0.40 |

| (Net Income/Total Equity) | Sales | Assets | Equity | |

| Net Income x | Assets | |||

| Assets | Total Equity | |||

| ROE | ROA x EM | |||

| ROA x (1+Debt-Equity Ratio) | 0.26 | |||

| ROE | Sales x | Net Income x | Assets | |

| Sales | Assets | Total Equity | ||

| ROA | ||||

| Profit Margin x | Total Asset Turnover x | Equity Multiplier | ||

| (Operating Efficiency) | (Asset Use Efficiency) | (Financial Leverage) | ||

| ROA | PM x Total Asset Turnover | 0.09 | ||

| (Net Income/Total Assets) | ||||

| Long-Term Financial Planning | ||||

| Construct Pro Forma Income Statement and Balance Sheets | ||||

| Develop Based on Percentage of Sales Approach | ||||

| Dividend Payout Ratio (d) | Cash Dividends | 0.06 | ||

| Net Income | ||||

| Addition to R/E to Net Income | Addition to RE | 4.91 | ||

| Net Income | ||||

| Retention/Plowback Ratio (b) | 1 – Dividend Payout Ratio | 0.94 | ||

| Capital Intensity Ratio | Total Assets | |||

| Sales | ||||

| External Financing Needed | Assets x | Change in Sales – | Spontaneous Liabilities x | |

| Sales | Sales | |||

| Change in Sales – PM x | Projected Sales x | x (1 – d) | ||

| Financial Policy and Growth | ||||

| Internal Growth Rate | ROA x b | 0.10 | ||

| 1 – ROA x b | ||||

| Sustainable Growth Rate | ROE x b | 0.60 | ||

| 1 – ROE x b | ||||

Categories: Accounting, Finance